GALLERY OF PURCHASES – CASE STUDIES

Please have a look at our recent properties detections examples:

The aim is to buy an asset that is always a low equity and cash flow risk, and this means that our clients’ properties will have the most likelihood to perform and play in a stable and safe environment, long and short term.

In a 7-10 years period, we want to maximize growth and perform extraordinarily on the second and third suburb property cycle.

We are in the money game to those who don’t know. We buy real estate for the long run; however, we need to make sure that in the short, medium, and long-term (7-10 years), we make equity as well.

We shouldn’t dream or hope on potential growth because an area is going through significant renewal, an Olympic or soccer game, a fancy look with a view or someone prediction which has a vast interest in the deal.

Investors should re-examine their investment strategy and what they plan to insert into their property portfolio.

A long term investment strategy is the key, and although the long term approach, investors should always aim to a preferred asset class in a particular suburb and quality property that enjoys high in-demand, which can push growth yearly or over a short period every few years.

Case Study 1

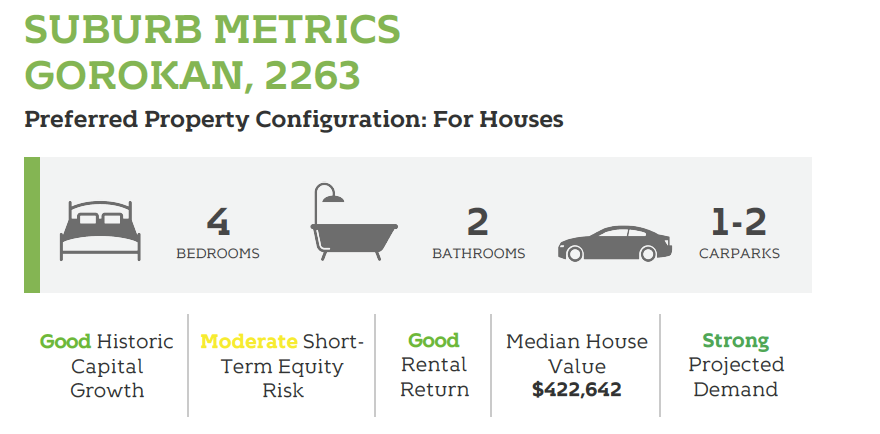

Suburb: Gorokan NSW 2263

Asset Class: House

Configuration: 4 bed 3 baths 1 car

Land size: 696m2

Purchase price: $498,000

Purchase date: Sep 2019

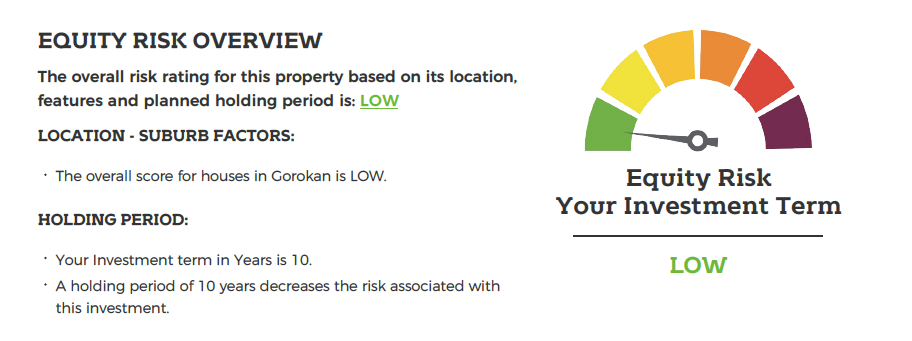

Risk analysis guide scores and data at Aug-Sep 2019

** Source – Risk Wise Property Review, Corelogic, ABS

** Short Term Equity Risk received a Moderate score only due to the severe bush fires across the Central Coast region at that time of the year, which could affect the short term demand for houses.

Sale History

**Realestate.com.au

Value adding: small Cosmetic Renovation

- Painting

- 5th bedroom Setup (Four beds on the main house and one bed on the attached granny)

- Granny flat/family retreat unit – update/refresh, Fan and new kitchenette installation.

Current Market value [December 2021]– $850,000 to $1,000,000+

Capital Growth: base on 850k, we achieved 70% growth in 2 years. (More conservative valuation at 810k will give us 62% growth)

Rental yield: 5.7%

Case Study 2

Suburb: Leopold VIC 3224

Asset Class: House

Configuration: 4 bed 2 baths 2 cars

Land size: 565m2

Purchase price: $535,000

Purchase date: April 2019

Risk analysis guide scores and data at March-April 2019

**Source – Risk Wise Property Review, Corelogic, ABS

Current Market value [December 2021]: $720,000 +

Capital Growth: 34% growth in 2.5 years

Rental yield: 4%

Case Study 3

Suburb: Wyoming, NSW 2250

Asset Class: House

Configuration: 3 bed 2 baths 2 cars

Land size: 746m2

Purchase price: $729,500

Purchase date: Nov 2020

Risk analysis guide scores and data from Oct-Nov 2020

**Source – Risk Wise Property Review, Corelogic, ABS

Current Market value (December 2021): $1,000,000 mark

Capital Growth: 27% growth in 1 year (Base on conservative value of 930k)

Rental yield: 4%

Case Study 4

Suburb: Curra, QLD 4570

Asset Class: House (Rural Residential)

Configuration: 4 bed 2 baths 2 cars

Land size: 6,090m2

Purchase price: $620,000

Purchase date: Nov 2021

**Source – Risk Wise Property Review, Corelogic, ABS

Current Market value (January 2022): $700,000-720,000 mark

Capital Growth: 16% growth or immediate equity in 3 months

Rental yield: 5%