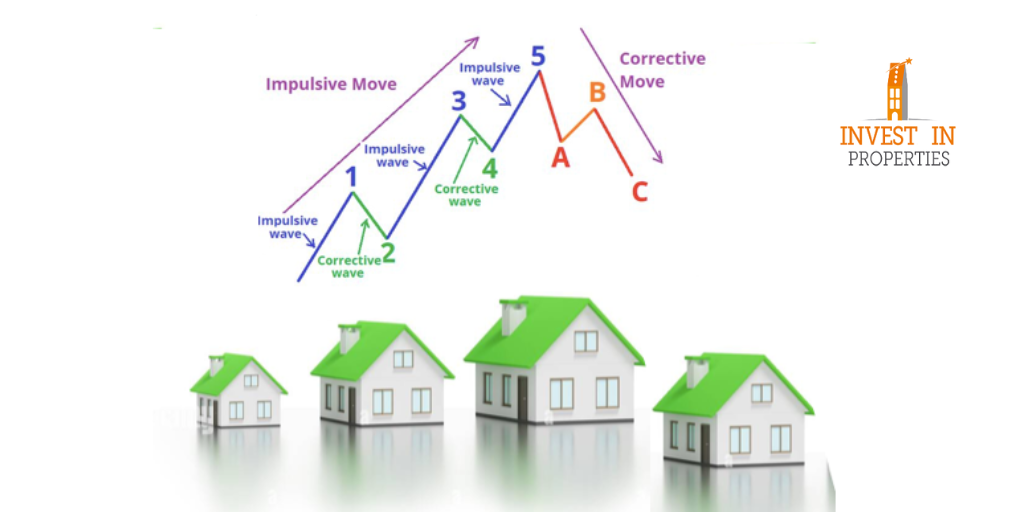

- Wave Patterns in Property Markets: Just as financial markets exhibit wave patterns based on investor sentiment and market cycles, property markets also experience similar trends. These can include periods of expansion, contraction, and consolidation. You can gain insights into potential future price movements by analyzing historical data and identifying wave patterns in property markets.

- Market Timing: Elliot Wave Theory emphasizes the importance of timing market entries and exits based on wave patterns. Similarly, timing the market in property investment can significantly impact your returns. By identifying specific wave patterns and understanding where the property market is in its cycle, you can strategically plan your property purchases to capitalize on potential price movements.

- Risk Management: Elliot Wave Theory encourages setting stop-loss orders to limit potential losses if the price moves against the predicted wave pattern. In property investment, you can apply risk management techniques by carefully considering factors such as location, property configuration, layout, conditions, position on the ground, rental demand, cash flow projections, and exit strategies. This helps minimize potential downside risks associated with property investments.

- Study Market Trends: Analyze historical data and market trends to identify wave patterns specific to the property market you are interested in. Look for cycles of growth, stagnation, and decline to gain insights into potential future movements.

- Combine with Fundamental Analysis: Elliot Wave Theory focuses primarily on technical analysis. To make well-informed property investment decisions, it’s essential also to incorporate fundamental analysis. Consider factors such as economic indicators, demographics, local development plans, new properties in the pipeline, infrastructure projects, asset class, configuration and rental demand to assess the property’s long-term value.

- Consult Professionals: Seek advice from real estate agents, property professionals, buyers’ advocates, or financial advisors who have expertise in both technical analysis and property investment. Their insights can help you validate your findings and provide additional perspectives.

- Diversification: Applying Elliot Wave Theory to property investment should not be the sole basis for decision-making. Diversify your property portfolio across different locations and types of properties to spread risk and capture potential opportunities in various markets.

To optimize your property investments and increase your chances of reaping benefits in both the short and medium term, it is essential to navigate the challenges posed by various consultants, professionals, and their firms who may have vested interests in the deals. Many marketing materials are designed to direct buyers toward specific projects or property opportunities, often accompanied by false promises or incentives taken out of context.

While it is important to note that the Elliot Wave theory is not foolproof, it can certainly serve as a valuable tool to enhance your likelihood of success in investment endeavors. However, it is crucial to complement this approach with thorough independent analysis and risk validation for each property you consider purchasing. By conducting comprehensive evaluations and verifying associated risks, you can effectively mitigate potential long-term risks.

In summary, to make the most out of your property investments, it is recommended to combine the utilization of techniques like the Elliot Wave theory with diligent independent analysis and risk assessment. This approach will help you make informed decisions and increase your chances of maximizing returns while minimizing potential pitfalls.